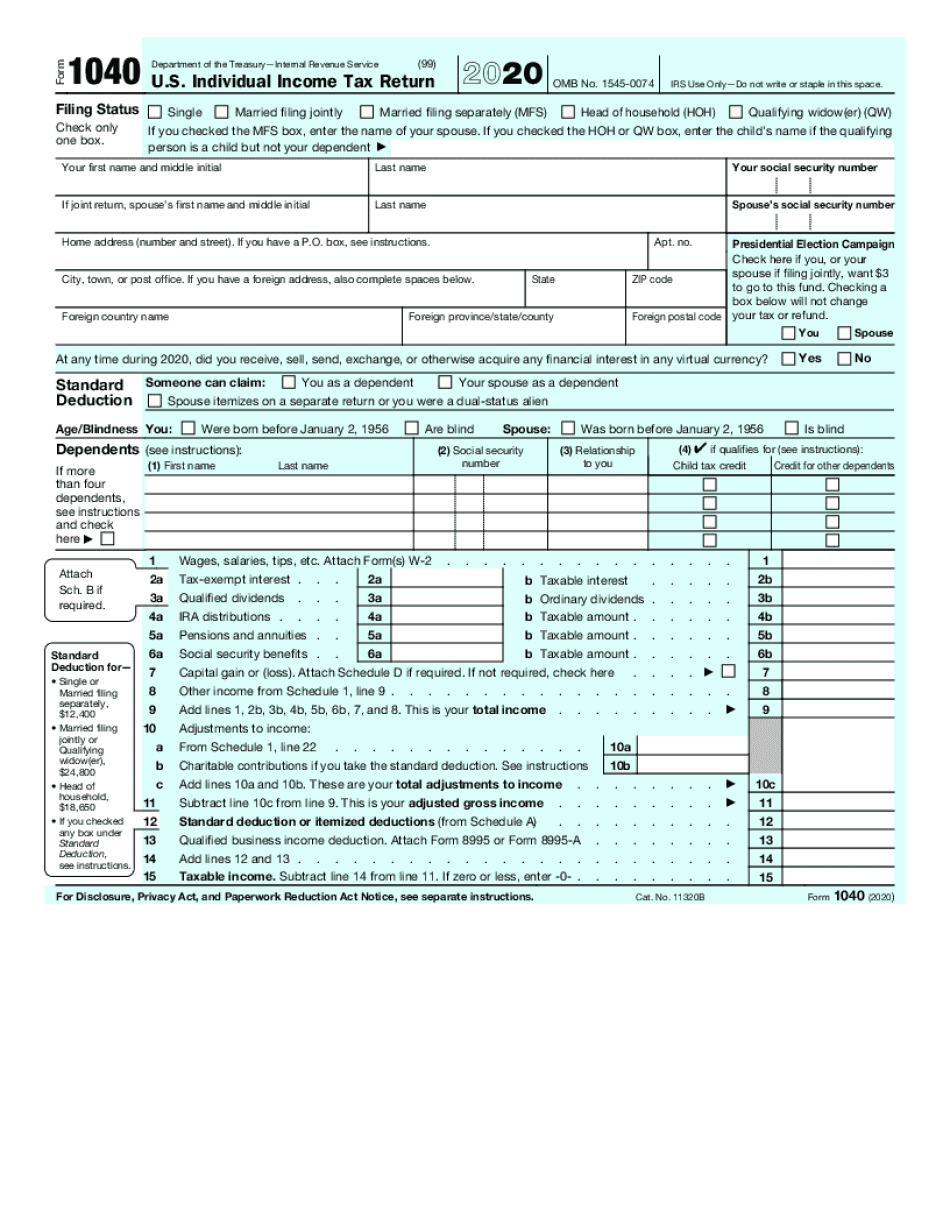

Unlike federal form 1040EZ, certain "above the line" adjustments may be claimed on a form 1040-A, including educators expenses, IRA deductions, student loan interest deductions and tuition and fees deductions. You can file a form 1040-A if your taxable income is less than $100,000 and your income is from the same kinds of income as you'd claim on form 1040EZ plus interest (line 8) and dividends (line 9) capital gain distributions (line 10) IRA distributions (line 11) distributions from pensions and annuities (line 12) and taxable Social Security and Railroad Retirement Benefits (line 14). A nice compromise between the federal form 1040 and the federal form 1040EZ is the often neglected federal form 1040-A. Individual Income Tax Return (downloads as a pdf). It's the longest, most complicated of the form 1040 series but it's also the safest: if you can't decide which form to use, there's no harm in choosing this one.įederal form 1040-A, U.S. There are no real restrictions (other than residency) that affect your ability to file federal form 1040. The most common federal income tax is the federal form 1040. Additionally, your available credits are limited to the earned income credit or the nontaxable combat pay election.įederal form 1040, U.S.

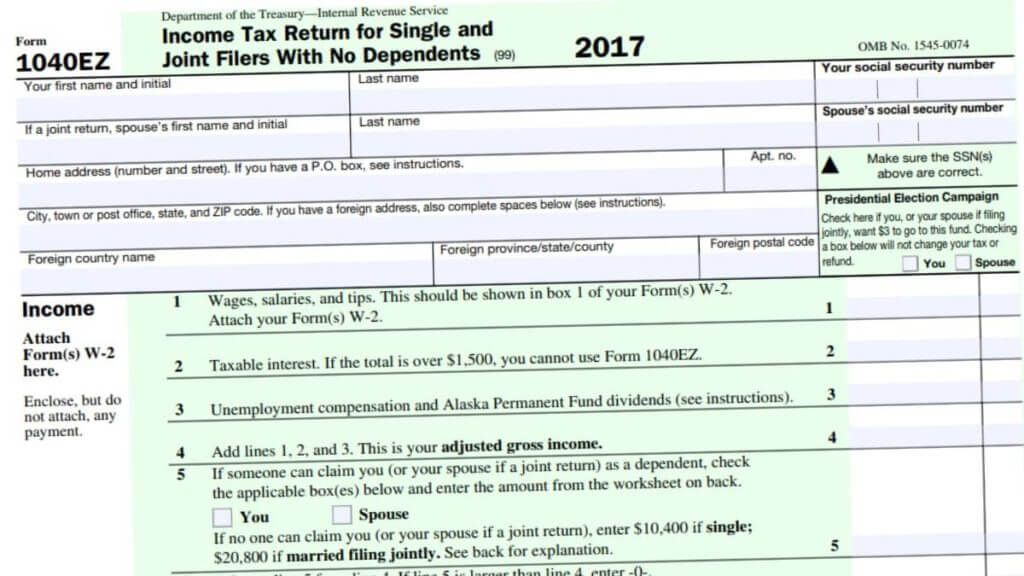

You may not itemize deductions (Schedule A) if you use the federal form 1040EZ: you must claim the standard deduction. You cannot file a federal form 1040EZ if you have self-employment income (Schedule C), rents (Schedule E) or capital gains and losses (Schedule D). Your income must consist only of wages, salaries and tips (see line 1), taxable interest of less than $1,500 (see line 2) and unemployment compensation or Alaska Permanent Fund dividends (see line 3). In addition, your taxable income must be less than $100,000. You also can't use federal form 1040EZ if you intend to claim the additional standard deductions (available to those taxpayers who are blind or over age 65) - those options are only available on the federal form 1040. If you have dependents or if you're filing as head of household, qualifying widow(er) or married filing separately, you may not use federal form 1040EZ no matter how easy you believe your return to be. You can opt to file a federal form 1040EZ if you're filing as single or married filing jointly with no dependents (remember, when it comes to kids, nothing is ever easy).

The key part of the 1040EZ is the "easy" in the title. Here's a quick rundown of the most common forms that are available on the Internal Revenue Service (IRS) website:įederal form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents (downloads as a pdf).

0 kommentar(er)

0 kommentar(er)